[PDF] Financial Markets Theory Equilibrium Efficiency And Information Springer Finance Ebook

Financial Markets Theory Equilibrium Efficiency And

Financial Markets Theory Equilibrium Efficiency And

Financial Markets Theory - Equilibrium, Efficiency and ... Financial Markets Theory covers classical asset pricing theory in great detail, including utility theory, equilibrium theory, portfolio selection, mean-variance portfolio theory, CAPM, CCAPM, APT, and the Modigliani-Miller theorem. Starting from an analysis of the empirical evidence on the theory, the authors provide a discussion of the ... Financial Markets Theory: Equilibrium, Efficiency and ... Financial Markets Theory covers classical asset pricing theory in great detail, including utility theory, equilibrium theory, portfolio selection, mean-variance portfolio theory, CAPM, CCAPM, APT, and the Modigliani-Miller theorem. Starting from an analysis of the empirical evidence on the theory, the authors provide a discussion of the relevant literature, pointing out the main advances in ... Financial Markets Theory - Equilibrium, Efficiency and ... Financial Markets Theory presents classical asset pricing theory, a theory composed of milestones such as portfolio selection, risk aversion, fundamental asset pricing theorem, portfolio frontier, CAPM, CCAPM, APT, the Modigliani-Miller Theorem, no arbitrage/risk neutral evaluation and information

Financial Markets Theory Quot Equilibrium Efficiency And

Modern Microeconomics Theory And Applications By H L Ahuja

Microeconomic Theory Springerlink

Solved The Efficient Markets Hypothesis Holds Only If All

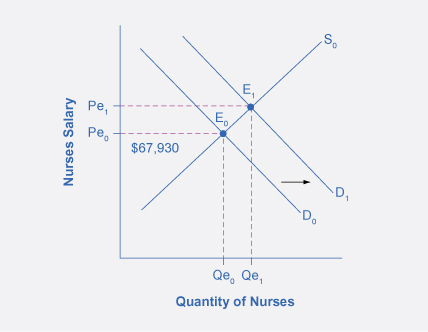

4 3 The Market System As An Efficient Mechanism For

0 Response to "Financial Markets Theory Equilibrium Efficiency And Information Springer Finance"

Post a Comment