[PDF] The Value At Risk VAR In The Banking System Ebook

Enterprise Risk Management For Insurers And Financial

Is This Why Deutsche Bank Is Crashing Again Zero Hedge

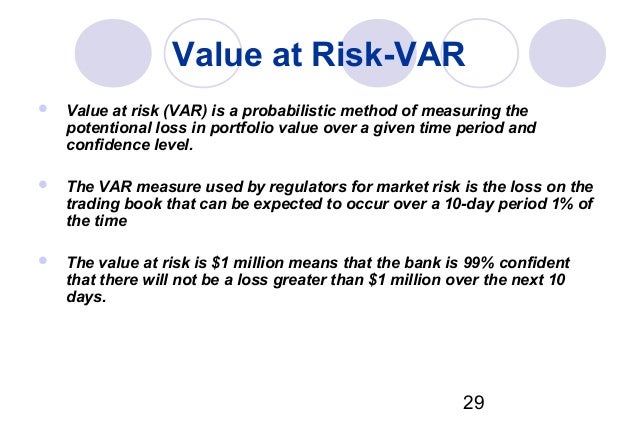

Value at Risk (VaR) Explained - Investopedia Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio or position over a specific time frame. This metric is most commonly used by ... Value at risk - Wikipedia Value at risk (VaR) is a measure of the risk of loss for investments.It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. The Value at Risk (VAR) in the banking system Jeyhun ... Value at risk was calculated on the GAP between loans and deposits of the banks of the Azerbaijan banking system with 95% of confidence level and holding periods for 10 days. The average interest rates of loans were taken as risk factor in

Risk Management Basel Ii

Eignung Des Value At Risk Zur Risikoquantifizierung Auf

0 Response to "The Value At Risk VAR In The Banking System"

Post a Comment